目錄

ToggleCompany Formation is the first key to start your business. Doing business activities without a valid business registration certificate is illegal in Hong Kong.

Setting up a company is much simpler than before, however, many people are not attentive enough and insufficiently prepared so that the registration procedure is extended.

This article mainly focuses on the following:

1. What to consider before setting up company

2. Company Registration Procedure, Costs and Registered Address.

3. What to pay attention to after the company is successfully registered.

We hope this may help business starters to reduce unnecessary mistakes and save time in preparing required documents.

Some online shop and consignment shop owners were reported and received notifications from the Inland Revenue Department for not applying business registration certificate. Therefore, obtaining BR before operating a business is the most important step to avoid any unnecessary losses or legal liabilities.

Before Registering a Company

Points to alert before setting up a company in Hong Kong

It is necessary to determine the company type of your business required, decide the members of your company, and the desired office address for your company.

What is an Unlimited Company and the difference with a Limited Company? Comparison of the setup cost of a Limited Company and Sole Proprietorship & Partnership.

| Limited company | Sole proprietorship/Partnership | |

| Applicant qualification | Both Hong Kong residents and non-Hong Kong residents | Hong Kong residents only |

| Number of members | 1 to 50 | 1 to 20 |

| Required time | 5-8 working days | Immediate to 2 working days |

| Government charges | Company registration fee: HK$1,720 Business registration fee: HK$250 (until 31 March 2022) |

Business registration fee: HK$250 (until 31 March 2022) |

| Required documents | 1. Forms of Incorporation from Companies Registry (NNC1); 2. Articles of Association; 3. Documents certified by accountants; 4. Minutes of the first meeting of directors and shareholders; 5. Minutes of the meeting of account opening; 6. Director and shareholders; and 7. Lists of registration |

Identity Card of Hong Kong |

Registering an unlimited company 2024 (Sole proprietorship/ Partnership)

Setting up an unlimited company means only obtaining business registration. The procedure is quick and simple, it basically only takes one to two working days only.

There is no upper limit of the responsibility of the proprietor and shareholders, therefore all members need to bear all debts of the company once the enterprise is forced to be closed.

However, the accounting and auditing fee is relatively low, as the declaration procedure is simple, and you only need to fill in the relevant items in accordance with the tax form.

Moreover, the most important point of forming unlimited company is the trust between partners. Therefore, it is more suitable for businesses with simple business scale or small capital. For example, online shops, consignment shops, etc.

Limited company

Limited company, also represents a limited liability company. Shareholders only responsible for the company’s debts with their own capital contributions in the legal status, thereby avoiding creditors from claiming company debts due to shortage of funds from shareholders. Different from sole proprietorship, auditing is necessary in preparing tax returns.

The number of shareholders is limited to 50 members, therefore registration procedure of limited company registration is simple, it only takes 2 or 3 working days.

One of the benefits of setting up limited company in Hong Kong: Clear company structure and flow of shares, which may increase the trust between directors and shareholders. Therefore, limited company is suitable for all business that requires high degree degree of trust, no matter start-ups, SME, or family business.

Click the link below to learn more about company formation details: https://www.conson.com.hk/eng/Company Registration

What are the advantages of operating a limited company in the market of Hong Kong?

In fact, members of sole proprietorship or partnership are relatively unprotected as they all have to bear huge financial debts when the company faces liquidation.

They may suffer from unlimited losses, at least one of the members must continue to pay the debts before clearing all debts. The loss of an unlimited company will threaten assets of members.

On the contrary, regulations of limited companies are much fewer. Basically, as long as the shareholders agree, the directors (i.e. shareholders of the executive business) may control company operation, they have more flexibility on making management decisions.

1. Limited liability

Business is completely separated from owners and management, Enterprise is responsible for debts, losses and legal claims instead of the owner (shareholder/ guarantor) or directors, thereby personal liability is reduced. As a shareholder, there is no legal obligation to pay the shares that more than the value they held in the enterprise.

Therefore, personal assets of shareholders could be protected, also the company only needs to pay the value of the unpaid shares when the company encounters financial difficulties.

2. Professional legal status

As a limited company, its professional status and corporate image is raised, thereby its business value is also increased.

Besides, government departments are strictly monitoring registered limited companies, accounting and reporting requirements are much more complicated than that of sole proprietorship or partnership enterprises. All company details and accounts are published in public records. Therefore, other individuals or enterprises can conduct credit checks on the targeted limited company.

Therefore, running a limited company will reduce your responsibilities while enjoying a professional image and status if your business encounters financial difficulties.

However, the required management costs on accounting or taxation are relatively higher.

Therefore, limited companies are generally more suitable for companies with a larger amount of capital, or those that need to do business with multi countries in order to reduce liability risks. But of course, every business is unique.

Seeking professional advice in order to ensure the selection of the best combination of companies now

1. Directors, secretaries, and shareholders of the company

Every company must have at least one natural person director and one company secretary.

Director – Sole director is not allowed to become company secretary. Directors of a limited company are elected by the general meeting of shareholders. They have the rights to decide and make final decisions of company operations.

Company Secretary – To ensure that company’s administrative and legal responsibilities are fully performed, and act as a corporate governance consultant. He must ordinarily live in Hong Kong if the company secretary is a natural person. Its registered office or main office must be in Hong Kong if the company secretary is a body corporate.

Shareholders – Shareholders are also an indispensable part of a Hong Kong company, and they often act as directors or secretaries at the same time.

2. Significant Controllers

The 2018 Companies Ordinance (Chapter 622) stipulates that companies incorporated in Hong Kong must identify persons who have significant control rights i.e. Significant controllers. The registry of important controllers must be kept for inspection by law enforcement officers upon request.

Shareholders holding more than 25% of company’s shares would be the significant controllers, they have voting rights, or even the right to appoint or resign the board of directors. The information of shareholders must be kept in the registry of significant controllers.

3. Designated Representative

Each company must assign at least one person as its representative to provide assistance to law enforcement officers on the matters of the registry of company’s significant controller.

The company’s designated representative must be any of the following, a shareholder, director or employee of the company who is a natural person resident in Hong Kong, or an accounting professional, a legal professional, a trust or corporate service licensee.

4. Company Name

First of all, company name must be unique. You are required to change the name in order to succeed in the application if the company’s name is too similar.You may go to the following website for preliminary inquiry to avoid similar registered company name you intend to apply https://www.icris.cr.gov.hk/

In addition, you are also recommended to use the Intellectual Property Department’s online search system to check trademark records so that to avoid the risk of “counterfeiting” or trademark infringement after deciding on the company’s name.

Click here to find our registrar or refer to the following system website of the Intellectual Property Department if you want to know about trademark registration procedures, that is https://ipsearch.ipd.gov.hk/.

5. Registered Address

Regarding to the Law, Hong Kong companies are restricted to use business address as its registered address as residential address could not meet their requirements.

As company address could be found in public search, some accounting firms, business centers or secretarial companies will also provide business addresses for business registration and communication.

In general, the cost of registered address service is about HK$100 per month, which includes a registered business address, collection of company mail and parcels, and a mobile electronic signage with a Chinese and English company’s name.

Therefore, using registered addresses, which are also called virtual office service, is legal and very common in Hong Kong. You may learn more information about virtual office in the following article: https://www.conson.com.hk/What is a virtual office?

It is important to pay attention to the quality of service provider and their licence when selecting a registered address (virtual office) service.

It is illegal to provide related company services without a license, and it may be forced to suspend business if the government finds out, therefore clients are required to change the address in a very short period of time.

To avoid spending extra time on unnecessary matters, you are advised to check the relevant licences through Companies Registry website of the Registered Office of Government Trusts and Corporate Service Providers.

It is not easy to find a virtual office provider with high quality and standard that suits your business needs. An outstanding virtual office provider may reduce your operating cost so that you may focus on your business development and achieve your business goals. Apply Conson Virtual Office Service IMMEDIATELY!

Besides checking the TCSP license, we should also pay attention to the following issues

1. The quality of the registered office building whether it may increase the company’s trustworthiness except meeting legal restrictions.

2. The ideality and accessibility of the building.

3. The scale and goodwill of the service provider, you should study its brief history to see if it has enough experience and its reputation in the market to protect the company’s interests.

4. The service standard and quality of service team members, professional customer service skill may help the company establish its positive image.

5. The fee and service included if it is clearly stated, there should be no hidden costs. This is to prevent causing your enterprise huge financial loss.

After concerning all the information mentioned above, you can decide to apply the limited company by yourself, or choose a company secretary service provider to assist your application.

Some documents are required to be submitted every year after successfully registered the company, such as Annual General Meeting minutes, Annual Return, etc.

The company will be charged a fine if the company fails to submit those documents on time. Therefore, company secretarial service of the first year will be included in most company formation service provided by comsec company or accounting firms. The company secretary provides professional consultation and advice to ensure that the company operates in compliance, such as reporting company’s structure the Companies Registry, changing in shareholders and directors if necessary, preparing and submitting Annual Return, drafting up the meeting agenda of annual general meeting, etc.

Preparing to Set up Limited Company

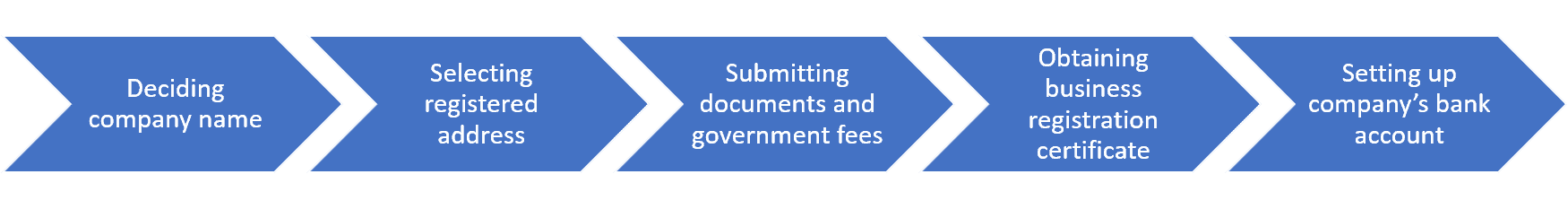

The application procedure of Company Registration.

1. Submitting documents and Government fees

You have to submit the application to the Companies Registry if you want to establish a limited company by yourself. Here are the documents required to be prepared:

- Incorporation Form NNC1

- Company Articles of Association

- Notice to Business Registration Office

Next, you can submit the documents to the Inland Revenue Department and the Companies Registry by the e-Registry, post, or through a secretarial company. It takes about 6-8 working days from submitting the application to successfully obtaining the business registration certificate.

However, there are also tons of service providers that may provide one-stop company formation and bank account opening appointment services in Hong Kong. It only costs HK$1000 to $2000.

Therefore, many people choose to appoint a company secretary instead of submitting by themselves, because the establishment process is complicated.

Company secretary service team will assist in the whole process, except preparing business registration and establishment forms, they will also prepare relevant documents such as bank account opening meeting minutes, accountant certification documents, and articles of association.

2. Obtaining Business Registration Certificate

You will receive the “Company Registration Certificate” and “Business Registration Certificate” once the company formation is approved. The relevant certificates will be issued in electronic format or in printed format, depending on the application method.

However, if you register your company through company secretary or accounting firm, you may get a company green box with whole set of documents, including company stock book, company record book, company seals, etc.

What is the purpose of the documents in the Company Registration green box?

(i) Company’s Articles of Association.

This is a legal document of a limited company stating the nature of the company, company members, registered capital and founder. The scope and restrictions of the powers of the directors are also clearly stipulated in the articles of association.

(ii) The declaration documents of director and secretary (Incorporation Form NNC1)

A document to declare to the Companies Registry the first company member, including the director, secretary and reserve director (if applicable), also this is a document that is required by the bank when opening a bank account or applying for banking services.

(iii) Company signature seals

It is generally kept by authorized persons and used to issue company documents, sign contracts and invoices.

(iv) Company seal

This seal should be kept by the company management level, and used to sign important documents such as conveyance contracts of property, tenancy agreements etc. The new Companies Ordinance allows companies to decide on their own whether to use the seal.

(v) Company record book

Recording the company’s directors, shareholders, secretaries and important controller information, such as name, address, appointment or resignation date. It must be updated in the record book when the company changes any information.

(vi) Stock book

The company must issue a share certificate to a shareholder within 2 months after the allotment of shares or the transfer of shares, stating the number of shares held by the shareholder and the total amount paid.

3. Opening bank account

A minimum deposit amount is required, and each bank requires a different amount of deposit.

In order to prevent international criminal groups or money laundering groups through the banking system, the bank may request clients to provide the identity and nationality information of the company’s directors and shareholders. A search fee sometimes is also required, however, the account application may be rejected after 1 or 2 months.

You must first complete the company’s business registration and company registration procedures to obtain the required documents before opening a bank account. You are required business certification or any proof for your business, such as the main customers, supplier information, shareholder identification documents, etc.

During the account application period, you may be also inquired about the business nature, source of funds, etc. But business proof is a must for most application. Therefore, company secretary company may assist in preparing or following up the official documents of these companies, and the directors only need to prepare their personal documents.

Most banks will require directors to submit applications in person, sign and verify their identity.

Hence, you can find a professional and experienced secretarial company to assist in bank account opening so that to avoid trouble and save time. Some documents should be submitted every year after successfully registering the company, such as the annual general meeting record, annual return and so on. The company may have to pay unnecessary fines if the company does not submit it on time.

The services will mostly include basic secretarial services in the first year when a general accounting company or a secretarial company registering. The company secretary provides professional consultation and advice to ensure that the company operates in compliance. These include the company’s structure reported to the Companies Registry, changes in shareholders and directors, preparing and submitting the company’s annual return, drawing up the meeting agenda for the company’s board of directors and arranging the annual general meeting, etc.

Complete Running a Company in the Late Stage

Annual management after the registration of the company.

1. Annual General Meeting

The main function of the annual general meeting is to review the company’s accounts and discuss issues such as dividends and important company’s decisions. Registered companies are required to hold annual general meetings within 18 months of incorporation, and hold annual general meetings for each financial year.

A limited company or a private company that is not a subsidiary public company must hold an annual general meeting within 9 months after the end of the accounting reference period. In the case of any other company, the annual general meeting must be held within 6 months after the end of the accounting reference period.

2. Annual Declaration

A private company must file its first annual return within 42 days after the first anniversary of its incorporation. The annual registration fee payable is HK$105.

A significantly higher registration fee will be required if the annual return is not delivered within 42 days on time. The following items are included in the annual declaration:

1. Details of the company’s issued share capital.

2. The name and address of the director and company secretary.

3. The name and address of the registered shareholder.

4. The amount of any registered charge guarantee.

The company is obliged to comply with the various requirements of the Companies Ordinance and make appropriate arrangements to deliver the annual return for registration on time.

The Companies Registry will not give any hint for the company to deliver the annual return. The maximum fine can reach HK$50,000 and the maximum daily fine is HK$1,000 if the payment is overdue. The responsibility will fall on the director.

Therefore, the company secretary will give the relevant notice one month before the date of submission of the report to avoid unnecessary losses for the customer if the registered company uses the secretarial service.

3. Renew Business Registration

The validity period of the business registration certificate is only one year, so it needs to be replaced regularly every year after the company’s founding anniversary. In addition, the business registration renewal request notice will be sent by the Business Registration Bureau in the middle of the month before the effective month of the renewal of the Business Registration Certificate. This fee is a government fee.

In addition to repaying the government fees owed, an additional fine of HK$300 per year is also required if the renewal of Business Registration Certificate is overdue.

4. Annual Audit

To check or review its company’s accounts and financial statements, the company needs to submit annual audit and income tax returns to the tax bureau for each fiscal year. It will receive the first tax return issued by the Inland Revenue Department about 18 months after the company is established in Hong Kong.

The directors of the company deliberately fail to take all reasonable steps to submit to the company’s review at the annual general meeting or any other general meeting as directed by the Court of First Instance, which is an offence.

Therefore, it is recommended to find a qualified and licensed secretarial company to do so to avoid all complicated procedures. You can also contact us in real time for a preliminary free consultation on the fees and detailed steps of running a company.

People also ask

-

1. What should I pay attention to when running a company?

It is necessary to determine the type of required business enterprise should be applied for a limited company or unlimited company and the final decision can be made where the registered address should be located after drawing up the company’s name before running a company.

-

2. What is an unlimited company?

Running an unlimited company means only obtaining business registration. The establishment procedures are quick and simple. Basically, it only takes one to two working days to obtain the business registration.

An unlimited company is literally what it means. There is no upper limit on the responsibility of the proprietor and shareholders. The proprietor and shareholders need to bear all the debts of the company once the enterprise is closed. However, the accounting audit fee is not too expensive, so the tax declaration procedure is also very simple, and you only need to fill in the relevant items in accordance with the tax form

-

3. What is a limited company?

A limited company also represents a limited liability company. Shareholders only need to be responsible for the company’s debts with their own capital contributions in the legal status, thereby avoiding creditors from claiming debts related to the company’s shortage of funds from shareholders. A limited company is different from an unlimited company in terms of taxation, which requires to make an account to be audited before tax returns.

-

4. Why should I choose a limited company since applying for an unlimited company is time-saving and convenient?

In fact, an unlimited company is relatively unprotected for shareholders or members. All shareholders have to bear huge financial debts when the company faces liquidation. There is no limit to the losses they may suffer. Someone must continue to pay before the company pays the bills.

#hong kong company formation cost #hong kong company name search #company setup in hong kong #how to register company in hong kong